But when you are not a regular PayPal associate while have not satisfied these conditions, after that acquiring the mortgage might be sometime tough.

As i possess earlier said, if you find yourself a regular PayPal user, then amount of loan you are permitted score could well be determined by the complete number of yearly conversion you was in fact capable of making on your PayPal membership. not, if you’re looking to obtain a more impressive sum of money above the limit from ?150,100 then you might getting running into certain restrictions.

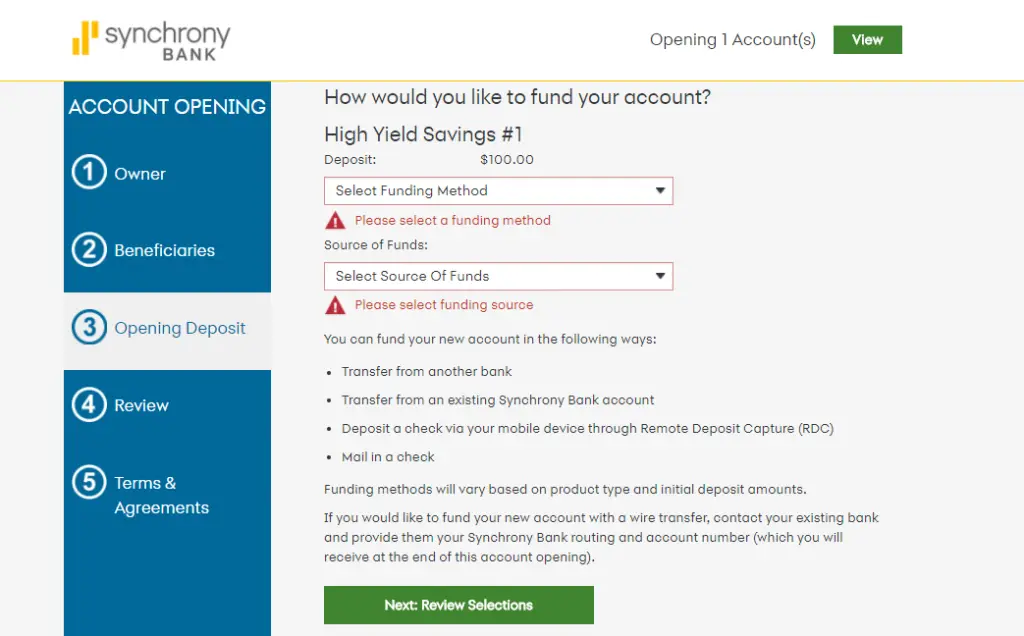

App Actions

This is how there will be use of the program which you are needed in order to complete. If the software is profitable, you may then discovered your loan in minutes.

However, same as I have prior to said, you to very important standards you should have found is actually for the PayPal membership having come around ninety days old.

You may be necessary to pay just a fixed number of currency. There is absolutely no a lot more focus, no late charge, with no a lot more cost. The level of repaired percentage you are necessary to spend will be dependent on the quantity we should obtain, exactly how many conversion process you create per year, plus the capabilities of the providers along with your target installment payment.

For people who bring a high cost percentage, you will then be provided a cheaper fixed commission whenever you offered less fee fees, then you’ve to expend a high repaired fee.

Which Fund PayPal Working capital

PayPal is created in the 1999 from the John Malloy away from BlueRun Options, this is certainly from the twenty-two years ago. It actually was initial install and you can inspired because a fund import service. Usually, PayPal has grown appreciably this also offers one another quick-label and you can a lot of time-name money so you can their users.

How PayPal Mortgage was Computed

- The earlier PayPal conversion process

- The brand new account percentage histories

- Their in past times taken loan.

These types of about three everything is what is going to be included together to decide the amount you may be capable to sign up for.

Benefits associated with PayPal Organization Weight

- Fast To try to get: PayPal Working-capital has one of the quickest software symptoms opposed every single most other option funding. You can simply use and then have your loan within this several minutes from software out of your PayPal membership. And next import the cash in the local lender account.

- Easy App standards: It looks every o an easy task to see the requirements needed so you can be eligible for brand new PayPal operating mortgage. After you’ve, get making use of about three standards expected people, (Deciding to make the questioned quantity of yearly transformation, that have a free account which is as much as 3 months old) as well as almost every other criteria, you can be certain you to having the loan are 99.9% sure.

- Low-Interest: When compared to some other short-identity loans, PayPal is fairly very economical. The eye towards the mortgage is loans for self employed with low revenue fairly quick particularly if you have a very good Paypal conversion background while love to bring to pay the loan with a decent part of their sales.

- An easy task to Pay: Paypal causes it to be simple for you to pay your mortgage. This new fees construction are unbelievable compared to the almost every other money alternatives. Paypal instantly deducts the exact agree installment percentages from the PayPal membership at the conclusion of per day’s sales months. you simply will not need to worry about setting a reminder to expend straight back your loan. PayPal automation does one to you personally effortlessly. Although you normally as well choose help make your financing fees yourself. This might be not left for you to determine. But automatically, PayPal place their payment propose to automated if you do not turn it yourself.