Article Note: The message associated with article is founded on the latest author’s views and you will guidance alone. May possibly not were examined, commissioned or otherwise recommended of the some of our very own circle lovers.

In order to re-finance a home loan, you improve your latest home loan with a brand new one to. Homeowners usually re-finance to obtain a lowered rate of interest, repay the loan smaller or transfer the security so you can cash.

Focusing on how to refinance a home loan and you will what to anticipate out of the new refinance procedure, plus closing costs or any other circumstances, can help you determine whether simple fact is that proper circulate.

- What is a home loan re-finance?

- Tips re-finance a home from inside the ten methods

- Why you ought to refinance

- How to use a home long term installment loans no credit check direct lenders loan refinance calculator

- Faq’s

What exactly is home financing refinance?

A mortgage refinance is when you alter your home loan if you are paying it well with a brand new home loan. People normally refinance to acquire a lower rate of interest otherwise monthly commission. not, an effective re-finance also can include shortening the loan identity, eliminating mortgage insurance rates or changing off an adjustable-rates home loan (ARM) so you’re able to a predetermined-speed loan.

At exactly the same time, if you’ve collected family equity usually, you could convert that security to help you bucks with a cash-away re-finance.

Tips re-finance a home in the 10 actions

Quite often, you’ll stick to the same steps you got to get the mortgage you happen to be paying down. Here’s how so you’re able to re-finance a mortgage inside the 10 procedures:

step one. Try using your financial purpose

A home loan re-finance merely is practical if this advances your financial state. Loan providers telephone call so it good web real benefit. Actually, loan providers must establish you will find a financial benefit to approving their refinance. Place a definite mission, wondering next issues so that you know precisely everything need to get to:

- How would you like a lesser month-to-month homeloan payment?

- Wanna pay-off the loan quicker by the changing to a shorter label?

- Would it be time for you to earn some renovations otherwise improvements to help you your house?

- Might you make use of paying off higher-attract personal credit card debt?

- Do you lower your month-to-month financial insurance policies?

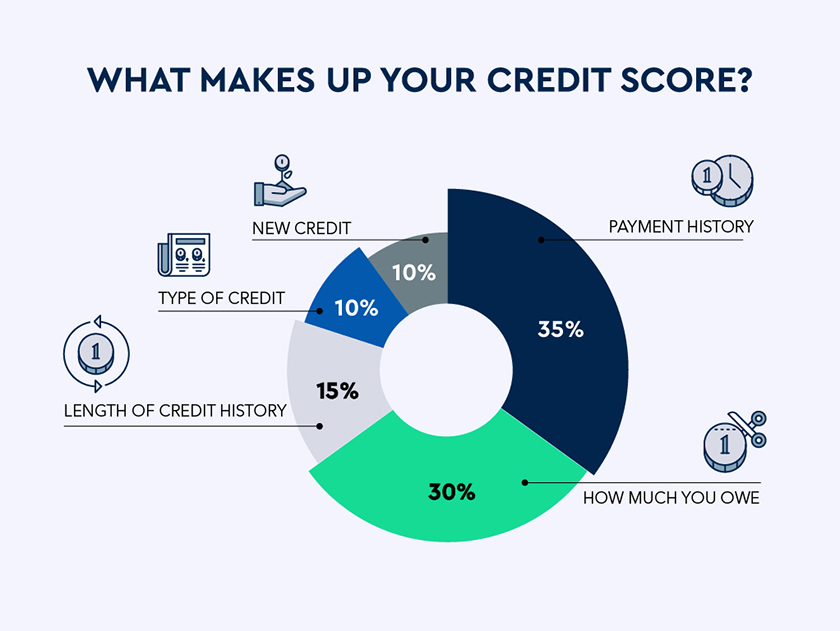

2. Check your credit rating

The re-finance credit rating is the most essential foundation regarding the rate a mortgage lender has the benefit of. When you just need the very least score between 580 and you can 620 for some re-finance apps, good 740 credit rating (or even more) may help you snag home financing during the an appealing rate of interest.

You can remove and check your own credit history at no cost of AnnualCreditReport. Notify the financing department in writing to correct any errors you spot-on the account.

step 3. Figure out how much equity you have

House equity is the difference in the house’s well worth and how far you owe on your latest financial. Including, in the event your residence is really worth $350,one hundred thousand and you also are obligated to pay $200,one hundred thousand, you really have $150,100000 worth of family guarantee.

As a whole, the greater number of security you have got, the greater the mortgage speed is. You can make use of a house worthy of estimator discover a concept of one’s residence’s worthy of, or ask an agent to set up a comparative industry analysis (CMA).

4. Complete your re-finance sort of

Once you know their re-finance objective, fico scores as well as have a rough thought of your own house’s really worth, it is the right time to decide which refinance program is the best match beforehand mortgage hunting.

Rate-and-term re-finance. These types of re-finance is the most popular for those who only must reduce your percentage, switch mortgage applications (refinancing of a keen FHA so you’re able to a conventional mortgage, particularly) or to alter the loan label. Settlement costs can typically be placed into the loan number and you may you don’t need to plenty of house guarantee as eligible.